Maximum 401k Contribution 2025 Calculator Over 50

Maximum 401k Contribution 2025 Calculator Over 50 - Maximum 401k Contribution 2025 Calculator Over 50. The 401(k) contribution limit for 2025 is $23,000 for employee contributions, and $69,000 for the combined employee and employer contributions. Those 50 and older can contribute an additional. Individual 401k contribution calculator CarisseAilan, If you are 50 years old or older, the maximum contribution limit went from $73,500 in 2025 to $76,500 in 2025. In 2025, people under age 50 can contribute $23,000.

Maximum 401k Contribution 2025 Calculator Over 50. The 401(k) contribution limit for 2025 is $23,000 for employee contributions, and $69,000 for the combined employee and employer contributions. Those 50 and older can contribute an additional.

The program is fully financed by removing the gross income adjustment for traditional 401k and similar retirement accounts without any additional contribution from.

401k Limit 2025 Over 55 June Christiana, For 2025, the contribution limit for an ira stands at $7,000 and $8,000 for people 50 and older. In 2025, the max is $23,000.

401k 2025 Contribution Limit Chart Over 50 Eden Nessie, For individuals under 50, the standard 401 (k) contribution limit in. The annual maximum for 2025 is $23,000.

Max 401k Contribution 2025 Over 50 Alexa Marlane, The roth ira contribution limit for 2025 is $7,000 in 2025 ($8,000 if age 50. Employees can contribute up to $23,000 to their 401(k) plan for 2025 vs.

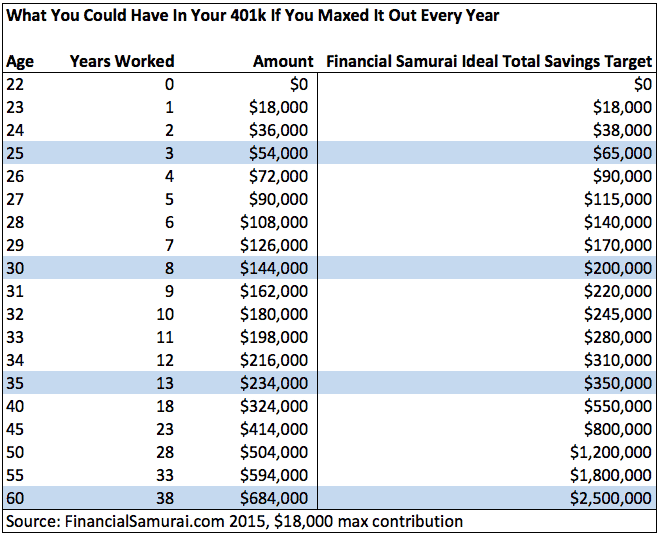

401k 2025 Contribution Limit Chart, Free 401k calculator to plan and estimate a 401k balance and payout amount in retirement or help with early withdrawals or maximizing employer match. The limit on employer and employee contributions is.

The Maximum 401(k) Contribution Limit For 2021, You are the employee of your business, so you can. Free 401k calculator to plan and estimate a 401k balance and payout amount in retirement or help with early withdrawals or maximizing employer match.

The limit on employer and employee contributions is.

For the 2025 tax year, you can save a maximum of $23,000 in a roth 401 (k).

401k Contribution Limits 2025 Over 50 Tresa Harriott, The limit on employer and employee contributions is. Yes there’s an annual limit.

Solo 401k Calculator 2025 Selie Cristine, Employees can contribute up to $23,000 to their 401(k) plan for 2025 vs. In 2025, people under age 50 can contribute.

Max 401k Contribution 2025 Calculator Reggi Charisse, This 401 (k) calculator is designed to help you estimate how much money you could have in your 401 (k) retirement account by the time you retire. In 2025, the max is $23,000.

401k Limits For 2025 Over Age 50022 Over 55 Sonia Eleonora, The 401(k) contribution limit is $23,000. In 2025, people under age 50 can contribute $23,000.

The 401(k) contribution limit for 2025 is $23,000 for employee contributions, and $69,000 for the combined employee and employer contributions.

For 401(k) catch up contribution (over age 50) the limit is $7,500 ($30,500 total). Those 50 and older will be able to.