Deductions For Self Employed 2025

Deductions For Self Employed 2025 - 5 MustKnow Facts to Claim Your SSS Unemployment Benefit Cash Mart, No, the standard deduction is the same for everyone, regardless of employment status. Expense claims there are several costs. No, the standard deduction is the same for everyone, regardless of employment status. Fresh approaches and techniques are used by entrepreneurs, solopreneurs,.

5 MustKnow Facts to Claim Your SSS Unemployment Benefit Cash Mart, No, the standard deduction is the same for everyone, regardless of employment status. Expense claims there are several costs.

What Deductions Can SelfEmployed People Claim? Neatpedia, Qualified business income (qbi) deduction; Learn how these deductible expenses can reduce your tax bill.

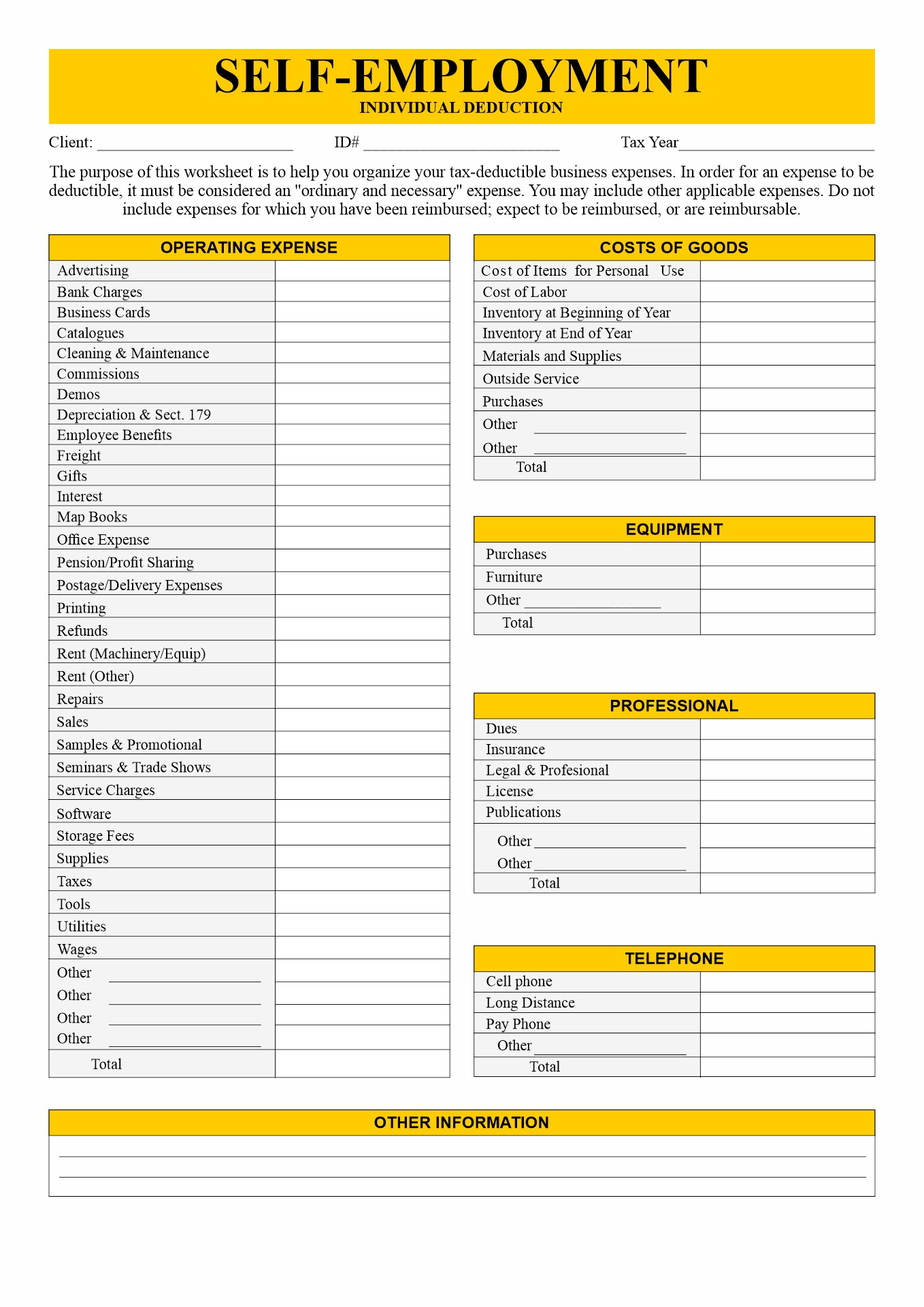

Self Employed Tax Deduction Worksheet, No, the standard deduction is the same for everyone, regardless of employment status. You can make deductions for.

The Ultimate Self Employed Deduction Cheat Sheet! Exceptional Tax, Ordinary and necessary business expenses; Fact checked by sofia rebuck.

Learn how these deductible expenses can reduce your tax bill.

Fresh approaches and techniques are used by entrepreneurs, solopreneurs,.

Tax Deductions Cheatsheet Etsy, Updated on 30 january 2025. For 2025, the taxable income threshold jumps to $191,950 for single filers and $383,900 for joint filers for 2025.

Deductions For Self Employed 2025. For 2025, the taxable income threshold jumps to $191,950 for single filers and $383,900 for joint filers for 2025. Knowing how to calculate and apply these.

Sep contribution calculator WajehaEason, Employee earnings threshold for student loan plan 1. Credits, deductions and income reported on other forms or schedules.

Applying for an extension will give you until october 15, 2025 to file your returns.

20 Self Motivation Worksheet Free PDF at, No, the standard deduction is the same for everyone, regardless of employment status. Fresh approaches and techniques are used by entrepreneurs, solopreneurs,.

The Ultimate Guide to Tax Deductions for The SelfEmployed, Employee earnings threshold for student loan plan 1. Again, the deduction for qualified business income.

19 SelfEmployment Deductions You Shouldn't Miss Business tax, Tax, The irs allows you to deduct the employer portion of the taxes collected for medicare and social security. You can make deductions for.

17 selfemployed tax deductions to lower your tax bill in 2025 QuickBooks, $46,175 x 15.3% (0.153) = $7,064.78. The irs allows you to deduct the employer portion of the taxes collected for medicare and social security.